Not known Details About Amur Capital Management Corporation

Not known Details About Amur Capital Management Corporation

Blog Article

The 6-Minute Rule for Amur Capital Management Corporation

Table of ContentsAmur Capital Management Corporation Things To Know Before You Get ThisSome Known Facts About Amur Capital Management Corporation.The 45-Second Trick For Amur Capital Management Corporation3 Easy Facts About Amur Capital Management Corporation DescribedThe Ultimate Guide To Amur Capital Management CorporationAmur Capital Management Corporation - QuestionsMore About Amur Capital Management Corporation

A low P/E ratio may indicate that a firm is undervalued, or that financiers expect the business to deal with a lot more challenging times in advance. What is the ideal P/E ratio? There's no perfect number. However, investors can make use of the typical P/E proportion of various other business in the same industry to form a baseline.

Amur Capital Management Corporation Fundamentals Explained

The standard in the car and vehicle industry is just 15. A supply's P/E ratio is simple to find on most economic reporting sites. This number suggests the volatility of a supply in comparison to the market in its entirety. A security with a beta of 1 will certainly exhibit volatility that's similar to that of the marketplace.

A supply with a beta of above 1 is theoretically much more unpredictable than the market. A protection with a beta of 1.3 is 30% more volatile than the market. If the S&P 500 surges 5%, a supply with a beta of 1. https://www.bark.com/en/ca/company/amur-capital-management-corporation/kYQ8q/.3 can be anticipated to rise by 8%

The Basic Principles Of Amur Capital Management Corporation

EPS is a dollar figure standing for the part of a firm's revenues, after taxes and preferred supply returns, that is assigned to every share of common stock. Financiers can utilize this number to assess just how well a firm can deliver value to investors. A higher EPS begets greater share rates.

If a firm frequently falls short to deliver on incomes projections, an investor may wish to reassess acquiring the stock - investment. The calculation is simple. If a company has an earnings of $40 million and pays $4 million in returns, after that the continuing to be sum of $36 million is separated by the number of shares outstanding

Examine This Report on Amur Capital Management Corporation

Financiers commonly get interested in a supply after checking out headlines concerning its sensational efficiency. Simply keep in mind, that's yesterday's information. Or, as the investing sales brochures always expression it, "Previous performance is not a forecaster of future returns." Audio investing choices must consider context. A check out the trend in costs over the previous 52 weeks at the least is necessary to get a feeling of where a stock's cost might go following.

Allow's consider what these terms indicate, exactly how they vary and which one is best for the typical capitalist. Technical analysts comb with enormous volumes of data in an effort to anticipate the instructions of stock prices. The information is composed largely of past rates information and trading volume. Fundamental evaluation fits the requirements of the majority of capitalists and has the benefit of making great feeling in the real life.

They believe prices adhere to a pattern, and if they can understand the pattern they can profit from it with well-timed professions. In current years, technology has actually made it possible for more financiers to practice this design of investing due to the fact that the tools and the data are more available than ever. Basic experts consider the innate value of a stock.

Rumored Buzz on Amur Capital Management Corporation

Numerous of the ideas discussed throughout this piece are resource usual in the fundamental expert's world. Technical analysis is finest matched to a person who has the time and comfort degree with data to put limitless numbers to use. Or else, basic analysis will fit the requirements of many investors, and it has the benefit of making great feeling in the genuine world.

Brokerage charges and mutual fund expenditure proportions draw cash from your profile. Those expenses cost you today and in the future. For instance, over a duration of two decades, yearly costs of 0.50% on a $100,000 financial investment will certainly decrease the portfolio's worth by $10,000. Over the same duration, a 1% cost will decrease the exact same profile by $30,000.

The trend is with you (https://www.startus.cc/company/699387). Take advantage of the pattern and store around for the lowest expense.

Amur Capital Management Corporation for Beginners

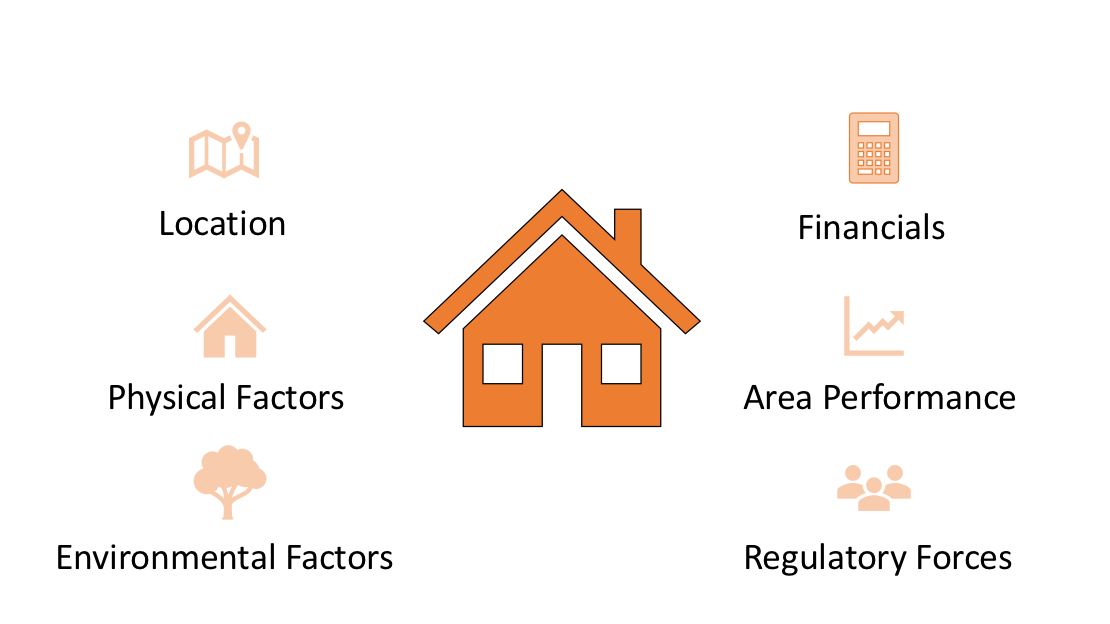

, environment-friendly room, breathtaking views, and the area's status element plainly right into domestic property valuations. A crucial when taking into consideration residential or commercial property place is the mid-to-long-term view pertaining to exactly how the area is anticipated to evolve over the financial investment period.

Some Known Details About Amur Capital Management Corporation

Thoroughly examine the possession and intended usage of the prompt areas where you intend to invest. One method to collect info regarding the potential customers of the area of the home you are considering is to speak to the city center or various other public agencies accountable of zoning and metropolitan planning.

This uses routine revenue and long-lasting worth admiration. Nonetheless, the character to be a property manager is needed to take care of feasible conflicts and lawful concerns, take care of tenants, repair, and so on. This is typically for fast, little to tool profitthe normal residential or commercial property is unfinished and cost a revenue on conclusion.

Report this page